Dec 11, · As long as there is an intentional plan to increase accounts receivable or inventories, a few periods of low, or even negative, cash flow from operations isn’t necessarily a red flag. Still, to be a sustainable venture, your business needs to maintain a positive cash flow from operations, and ideally increase this balance every quarter (or year at minimum).Estimated Reading Time: 9 mins Sep 12, · Essays require a Do Cash Flow Business Plan lot of effort for successful completion. Many small details need to be taken care of for desired grades. Therefore, we recommend you professional essay tutoring. The expert essay tutors at Nascent Do Cash Flow Business Plan Minds will elaborate every single detail to you. They will teach you how to /10() We have a convenient order form, which Do Cash Flow Business Plan you can complete within minutes and pay for the order via a secure payment system. The support team will view it after the order form and payment is complete and then they will find an academic writer Do Cash Flow Business Plan who matches your order description perfectly. Once you submit your /10()

Business Plan Essentials: Writing the Financial Plan

Cash flow is the lifeblood of every business. Having too little of it hampers your ability to pay your suppliers or employees on time, and having too much indicates that you could do cash flow business plan making an investment in extra inventory, additional machinery, or a much-needed store renovation.

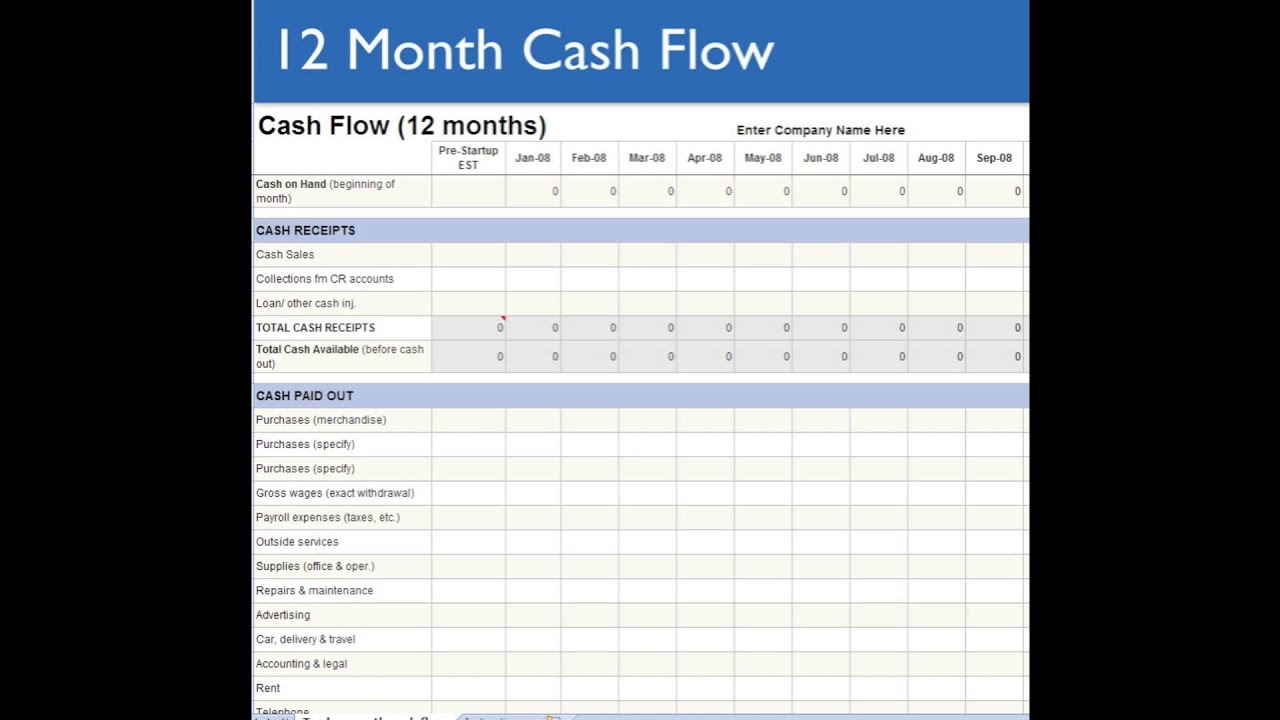

In a previous article on herewe provided an introduction on monitoring monthly cash flow. A cash flow analysis is a method for examining how a business generates and spends money over a specific period of time. It can help you figure out where your money is going and how much cash you have available at a given moment. The cash flow statement consists of three main sections: operating activities, investing activities and financing activities.

Do cash flow business plan are cash inflows and outflows directly related to your core business operations. In our initial budgeting model, we only added back depreciation to the net profit or loss from operations. To properly keep track of cash on hand—and perform an accurate cash flow analysis—we would need to get more granular and account for changes in accounts payable, accounts receivable, inventory, and tax payment, do cash flow business plan.

Depending on the nature of your business, you may keep accounts receivable and payable from not only customers, but from suppliers as well. Our cash flow analysis template assumed an all-cash business, so you would need to make the following adjustments related to operating activities. This process do cash flow business plan reconciling net income with net cash flow from operating activities is known as the indirect method.

Depending on the unique situation of your small business, insert additional rows as needed between lines 31 and 32 to account for cash inflows or outflows from operating activities.

Financing activities affect your cash balance. When you raise capital, such as taking out a term loan or withdrawing money from a line of working capital, you increase your available cash.

On the other hand, do cash flow business plan, when you pay back your lenders, you decrease your available cash. Notice on line 34 that we only deduct the principal portion of term loan payment, do cash flow business plan. This is due to the fact that an interest expense would already be included in your operating expenses.

Lucky you! When you sell equipment that wears out or acquire real estate to expand retail space, do cash flow business plan, your cash flow is affected. These are considered to be do cash flow business plan activities. Since there might not be any investing activities for a long time, our cash flow analysis template labels lines 38 and 39 as miscellaneous cash inflow and outflow, respectively. Additionally, we account for infusions or withdrawals of capital by the owner s in these lines, do cash flow business plan.

Aim for a positive cash flow from operations. Still, to be a sustainable venture, do cash flow business plan, your business needs to maintain a positive cash flow from operations, and ideally increase this balance every quarter or year at minimum.

Too many consecutive periods of negative cash flow from operations could spell trouble for your small business. Keep tabs on your accounts receivable. If your accounts do cash flow business plan keeps increasing period after period, make sure to have appropriate billing and collection procedures in place. Monitor how long clients take to pay you back. Some commercial lenders allow you to use your accounts receivable under 60 to 90 days as collateral for asset-based lending.

Plan ahead for cash crunches. If adding cash from operations line 32 to initial cash line 33 leads to a negative balance, it might be a sign to start thinking about securing some kind of loan to bridge those crunches. Decide on an appropriate form of financing. Budgeting for potential loan advances ahead of time allows you to estimate your target number when shopping around for financing.

It also gets you ready to provide documentation—including cash flow and income statements—to those potential lenders. Depending on the reason why a loan advance is needed, you may opt for a working capital or term loan. For example, if you expect to cover the shortfall in just a few weeks, then you may be better served by a working capital loan.

Beware of maxing out loan advances too fast. Securing a loan that is maxed out in just a few consecutive periods may be holding back the growth potential of your small business. Develop a strong history of payment to lenders. Money talks. Set a target repayment period and stick to it as much as you can throughout the year.

Understand your local market. Whether you had an entire semester to sell an old frying machine or just one day to get rid of a forklift, keep a pulse on market trends for your business equipment. Having more accurate pricing estimates allows you to better negotiate the next time that you have to sell or barter business equipment.

You need money to make money; so fuel your businesses with smart purchases of equipment or other assets when your cash flow allows you to comfortably do so. Cash flow analysis empowers you to make necessary corrections and take proactive steps to maintain a sustainable operation.

By adjusting your net income with key cash inflows and outflows, you get a clearer picture of how much cash is actually generated by core operations, a better sense of your financing needs, and a snapshot of the growth potential of your small business. Michael Jones is a Senior Editor for Funding Circle, specializing in small business loans.

He holds a degree in International Business and Economics from Boston University's Questrom School of Business. Prior to Funding Circle, Michael was the Head of Content for Bond Street, a venture-backed FinTech company specializing in small business loans. He has written extensively about small business loans, entrepreneurship, and marketing. Tags: Business Finance. All Growth and Operations All Expansion Management Marketing Operations COVID Resources Business Finance All Working Capital Loan Business credit Business credit card Invoice factoring Business line of credit Merchant cash advance Small Business Loans All Minority business loans Small business loans for women Small Business Administration SBA loans Term loans Why Funding Circle?

All Overview Success stories Reviews Small Business Interviews News All Growth and Operations - Expansion - Management - Marketing - Operations - COVID Resources Business Finance - Working Capital Loan - Business credit - Business credit card - Invoice factoring - Business line of credit - Merchant cash advance Small Business Loans - Minority business loans - Small business loans for women - Small Business Administration SBA loans - Term loans Why Funding Circle?

What is a Cash Flow Analysis? We will reference this example as we explain how to do a cash flow analysis. Cash Flow Statement: What Should You Include? Lines Cash Flows from Operating Activities These are cash inflows and outflows directly related to your core business operations. Lines Cash Flows from Financing Activities Financing activities affect your cash balance.

Lines Cash Flows from Investing Activities When you sell equipment that wears out or acquire real estate to expand retail space, your cash flow is affected. Grow your business with Funding Circle. Line Cash Flow from Operations Aim for a positive cash flow from operations.

Line Loan Advance Plan ahead for cash crunches. Line Loan Payment Develop a strong history of payment to lenders. Line Miscellaneous Cash Inflow Understand your local market. Michael Jones Michael Jones is a Senior Editor for Funding Circle, specializing in small business loans. Keep Reading See all articles A Quick Guide to Financial Statements Business Finance, do cash flow business plan. Apply now. Sign up for Funding Circle newsletter! Get our latest news and information on business finance, management and growth.

Fast, Affordable Business Loans: Learn more Get in Touch: Contact Us Join the community: Facebook YouTube Twitter LinkedIn. Great Review:.

How to Create a Cash Flow Forecast using Microsoft Excel - Basic Cashflow Forecast

, time: 14:34Example of a cashflow | Business plans | Business Finance | ACCA | ACCA Global

We have a convenient order form, which Do Cash Flow Business Plan you can complete within minutes and pay for the order via a secure payment system. The support team will view it after the order form and payment is complete and then they will find an academic writer Do Cash Flow Business Plan who matches your order description perfectly. Once you submit your /10() Example of a business plan. Example of a cashflow. As well as your business plan, a set of financial statements detailing you cashflow is essential. This will provide details of actual cash required by your business on a day-to-day, month-to-month and year-to-year basis. The needs of a business constantly change and your cashflow will highlight any shortfalls in cash that will Your cash flow statement reveals to you and anyone who reads your business plan exactly how much money comes in, how much money goes out, on what dates the inflow and outflows occur, and how much money is left blogger.comted Reading Time: 3 mins

No comments:

Post a Comment